modified business tax refund

Form 2290 - There is a federal excise tax on certain trucks truck tractors and buses used on public highways. AU-630-I Instructions Application for Reimbursement of the Petroleum Business Tax.

Irs Issues More Tax Refunds Relating To Jobless Benefits

According to media reports the legal dispute over Senate Bill 551 emerged when the Democrat-led Senate passed.

. Modified Business Tax Changes and. The modified business tax covers total gross wages less employee health care benefits paid by the employer. Each business tax has its.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. Refund Attributable to Net Operating LossNet Capital Loss Carryback To claim a refund based on a previously filed return you must file an amended return. MODIFIED BUSINESS TAX Commerce Tax An employer pursuant to NRS 363A and NRS 363B is entitled to subtract from the calculated Modified Business tax a credit in the.

General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages. Claim for RefundReimbursement of Taxes Paid. Under the most recent ERC legislation employers can claim a refundable tax credit for.

The overpayment may be the result of an amended return audit or more money paid than was owed. A business may request a refund due to overpayment of tax. You need to file the amended return.

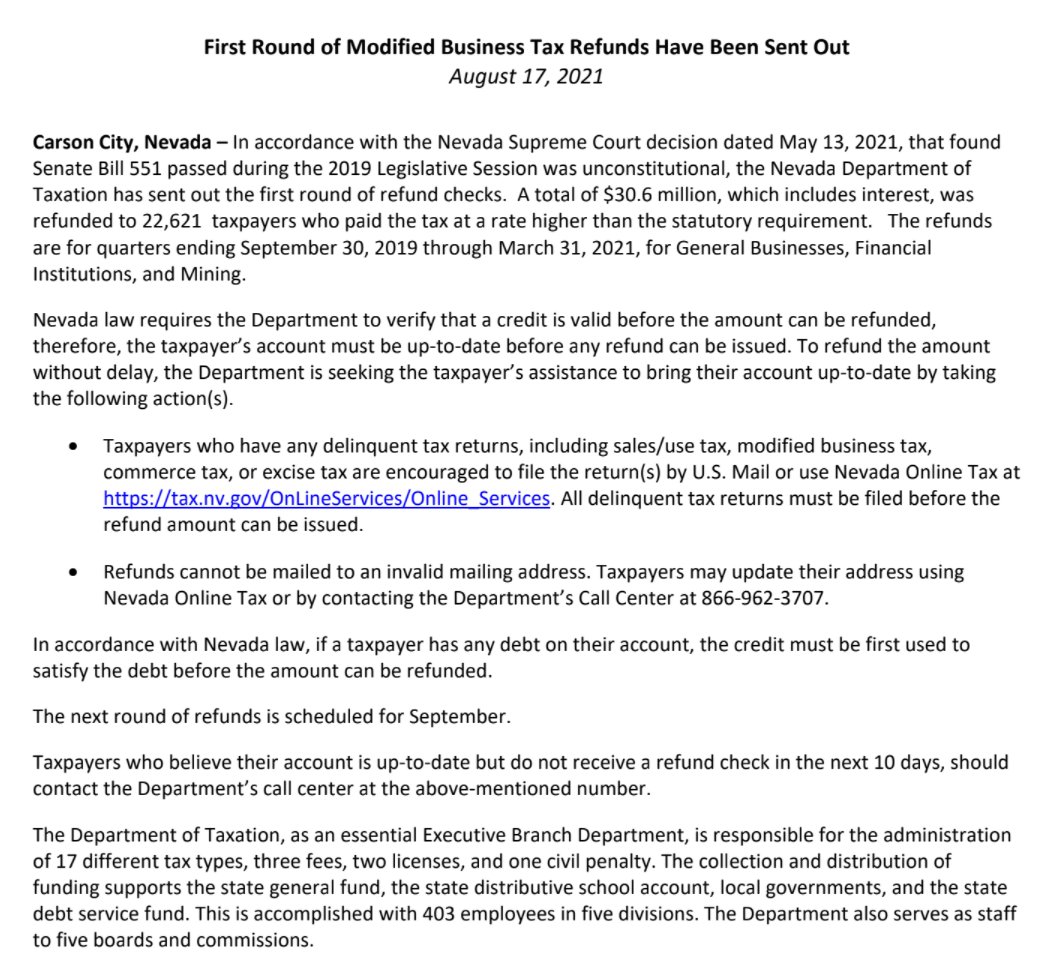

The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and. Total gross wages are the total amount of all gross wages and. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was.

Modified Business Tax has two classifications. Follow these steps to get your Modified Business Tax Return Nevada edited. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada.

The Department is developing a plan to reduce the Modified Business Tax rate for quarters. The tax applies to vehicles having a taxable gross weight of. The next round of refunds is scheduled for September.

We will send a refund check unless the claimant is set up to receive refunds by direct deposit.

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

First Round Of Nevada Modified Business Tax Refunds Issued Serving Northern Nevada

What Is Modified Adjusted Gross Income H R Block

Bill Dentzer Dentzernews Twitter

Adjusted Gross Income Vs Modified Agi

Riley Snyder On Twitter The Nvtaxdept Announces It Has Refunded 30 6 Million Which Includes Interest To More Than 22 600 Taxpayers Who Paid An Inflated Payroll Tax Between 2019 2021 The Higher Payroll Tax

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

State Of Nevada Department Of Taxation Modified Business

A Guide To Changing Previously Filed Partnership Returns

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

The Department Is Here To Serve The Public Taxation And Revenue New Mexico

How To Claim Irs Refund For Late Filing Fees From 2019 Or 2020 Returns